Countem

Verified Certified Fraud Examiner and Accountant

- Joined

- Dec 31, 2019

- Messages

- 1,303

- Reaction score

- 7,559

The below press releases from the SEC, Department of Justice, and CFTC provide a plethora of information about the developing situation.

I have quoted the charges and as well as what each entity is seeking.

I have quoted the charges and as well as what each entity is seeking.

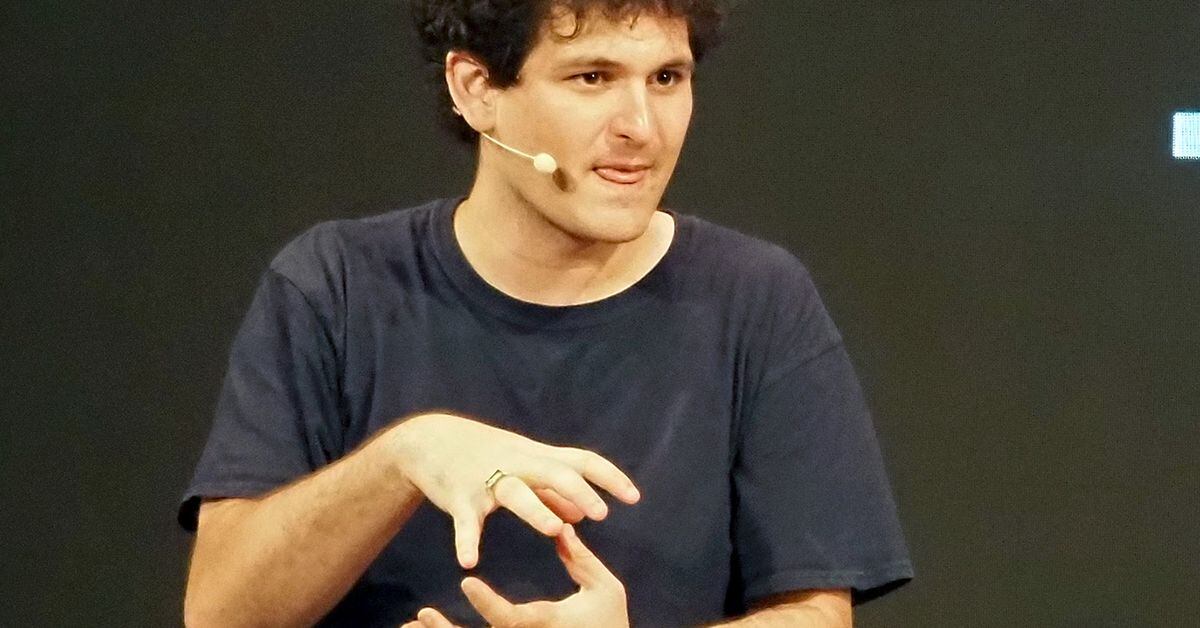

The Securities and Exchange Commission […] charged Samuel Bankman-Fried with orchestrating a scheme to defraud equity investors in FTX Trading Ltd. (FTX), the crypto trading platform of which he was the CEO and co-founder. […]

According to the SEC’s complaint, since at least May 2019, FTX, based in The Bahamas, raised more than $1.8 billion from equity investors, including approximately $1.1 billion from approximately 90 U.S.-based investors.

The SEC’s complaint seeks injunctions against future securities law violations; an injunction that prohibits Bankman-Fried from participating in the issuance, purchase, offer, or sale of any securities, except for his own personal account; disgorgement of his ill-gotten gains; a civil penalty; and an officer and director bar.

[A]n Indictment charging SAMUEL BANKMAN-FRIED, a/k/a “SBF,” with conspiracy to commit wire fraud, wire fraud, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, conspiracy to commit money laundering, and conspiracy to defraud the Federal Election Commission and commit campaign finance violations [has been unsealed].

[The charges of] two counts of wire fraud conspiracy, two counts of wire fraud, and one count of conspiracy to commit money laundering, each [carry] a maximum sentence of 20 years. [SBF] is also charged with conspiracy to commit commodities fraud, conspiracy to commit securities fraud, and conspiracy to defraud the United States and commit campaign finance violations, each of which carries a maximum sentence of five years.

The complaint charges all three defendants with fraud and material misrepresentations in connection with the sale of digital commodities in interstate commerce. Further, the complaint asserts that defendants’ actions caused the loss of over $8 billion in FTX customer deposits.

In its continuing litigation against the Defendants, the CFTC seeks restitution, disgorgement, civil monetary penalties, permanent trading and registration bans, and a permanent injunction against further violations of the Commodity Exchange Act (CEA) and CFTC regulations, as charged.

Last edited: